Table Of Content

- My Account

- Provide alternate proof of good credit history

- What Are No-Credit-Check Apartments?

- No Rental History, No Problem: A Guide to Securing an Apartment Without Rental History

- Buying Your First Home in Portland, OR? Here’s How Much Money You Need to Make

- How to rent an apartment with no or poor credit

- Can a Cosigner Help Me Get an Apartment?

- Pay off debts

If you have a high income, you may be able to join forces with someone with a lower income but higher score. You should also find it easier to save money as living expenses tend to be lower with roommates. Just make sure you know how to find a good roommate that fits with your lifestyle. There are many strategies you can use to get an apartment even when your credit score is less than desirable. Be ready to approach your prospective landlord beforehand, so that you can present your case and yourself professionally.

My Account

You’re more likely to find no credit check apartments going this route. As of July 2024, security bonds will be capped at an amount equal to one month’s rent. Previous laws allowed up to three months rent to be collected in bond, on top of the standard first month paid before occupancy.

Provide alternate proof of good credit history

This influences which products we write about and where and how the product appears on a page. That includes your student loans or car loans, which can hinder your ability to pay your other bills. Be sure to also take advantage of programs like Income Based Repayment plans if they’re available.

What Are No-Credit-Check Apartments?

Understanding what a credit report says about you can help you negotiate a rental agreement. Ultimately, your credit report is just a tool that people use to decide if you will be a good tenant. That's why, if you have a good explanation for your situation, you might be able to find someone willing to work with you. Instead of searching for apartments without credit checks, you can focus on setting goals for yourself to help build your credit. Ask a close relative or loved one whether they would be willing to make you an authorized user on their credit card account.

No Rental History, No Problem: A Guide to Securing an Apartment Without Rental History

You never know when something as simple as covering the snow removal costs or mowing the lawn each week may change their mind. Experian websites have been designed to support modern, up-to-date internet browsers. If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks. It is recommended that you upgrade to the most recent browser version.

Buying Your First Home in Portland, OR? Here’s How Much Money You Need to Make

The Side Effects of Bad Credit - Investopedia

The Side Effects of Bad Credit.

Posted: Tue, 29 Aug 2023 07:00:00 GMT [source]

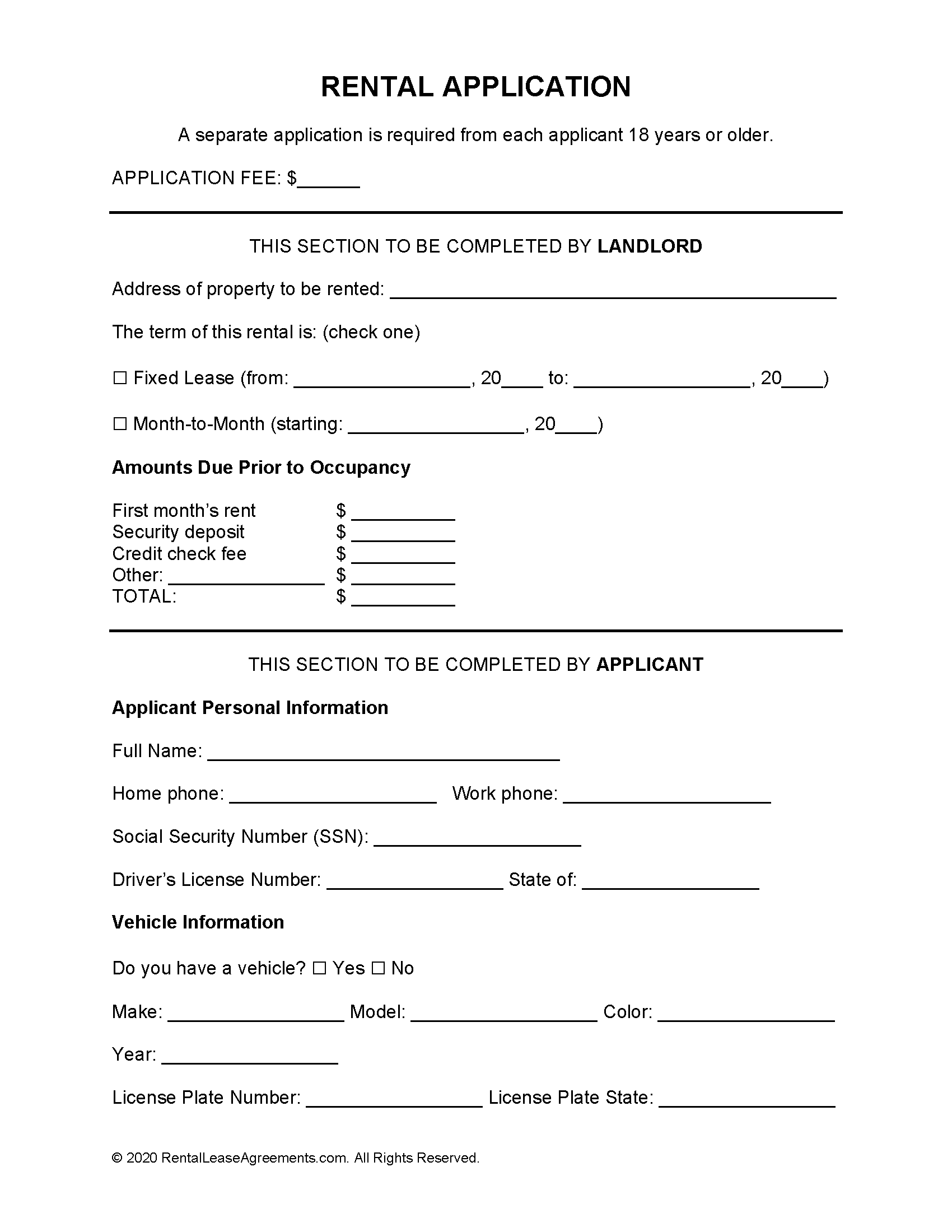

Here’s what to expect with a no-credit-check rent-to-own program and how to avoid potential pitfalls. In the quest for a new apartment, encountering the challenge of credit checks is a common hurdle. It's a step landlords often use to gauge a potential renter's financial reliability. Essentially, a credit check helps landlords predict how likely you are to pay rent on time, based on your past financial behavior. This is also evident when you consider the average credit score of renters in the U.S. stands at 638. If you have credit that falls in the “fair” ( ) or “bad” ( ) ranges, you might find yourself searching for a rental that doesn’t require a credit check as part of the application.

How to rent an apartment with no or poor credit

Beware of deals that seem too good to be true or lack pictures or adequate descriptions. You should also be wary of even going to see an apartment with red flags in its listing. The California Tenant Protection Act of 2019 has been amended, altering rules around “no fault” evictions or termination of a residential lease agreement. As of April 2024, more details will be required if a homeowner wants to end a tenancy due to moving-in or undergoing a major remodel of the property. Just tell us how much you owe, in total, and we’ll estimate your new consolidated monthly payment.

Can a Cosigner Help Me Get an Apartment?

Of course, you know you’ll always pay the rent on time, but you have to prove that to your landlord with a good track record of on-time rent payments. Having one or more empty apartments is expensive for property managers and landlords. They have to pay the mortgage and utilities without any reimbursement in the form of rent. Because of this, you may be able to rent a place without a credit history if you’re able to move in immediately. The easiest way to rent with bad credit is by leasing with the help of a cosigner.

You must also remain in the home for at least 12 months before the home can go back on the rental market. Same goes for the close family of the homeowner (e.g. spouse, parents, children, grandchildren). Their names and your relationship will need to be disclosed in the termination notice and the same rules will apply. If you or family already occupies a rental unit on the property, or if there is a similar unit available on the property, you may not use this as grounds for termination of a lease. From new rules on security deposits and evictions to tenant screening, here are 5 major changes that Californian landlords need to be aware of in 2024.

Compensation may factor into how and where products appear on our platform (and in what order). But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That's why we provide features like your Approval Odds and savings estimates. If you find errors, you can challenge them and request removal from the credit bureau. Ideally, you want to keep your credit use below 30% of your available credit to avoid having your score may take a negative hit. You can pay down your debts to reduce this number, increasing your credit score.

Sometimes you can find really good apartments with no credit check using the following methods. Real estate agents have lots of knowledge about your rental market, especially agents who work with landlords or property managers. You can contact a brokerage and ask to speak with an agent with experience working with landlords. When you find the right agent who does, ask about your options or if they know of any apartments that don’t need a credit check. It’s also a good idea to ask if they know a landlord who is willing to work with you.

These types of properties may be apartments, but they are often houses, townhomes, and condominiums as well. If you're flexible about property type, private properties can be a great option. By signing a three-month lease, or going month-to-month, the landlord can opt to not renew you for a longer term if you aren’t paying.

If you’re transitioning to a new job, consider showing the offer letter from your new employer detailing your new compensation. Ideally, this person would know some of your personal finance history and would be in a good position to discuss your financial prospects. An employer who could speak to the likelihood of your continued employment is one good option. Another is a previous landlord who can vouch for your responsibility in making timely rent payments. Your credit score doesn't always make or break your chances to rent an apartment. Very often, proof of income is just as, or even more important, than credit.

No comments:

Post a Comment